Few understand that you just need more Bitcoin to save.

“You can always make more money, but you can never make more time.”

The source of this quotation is still very mysterious. I have heard it throughout my life, but I have never been able to find out who it was originally from. Anyway, I find it full of meaning.

This quote makes even more sense when I see some people going on a frantic quest to earn more and more fiat money. While we are experiencing great monetary inflation, some people still believe that the U.S. dollar is all-powerful.

All these people think about is earning more and more U.S. dollars to accumulate more and more.

Accumulating more and more U.S. dollars will not make you happy

I still wonder how these people don’t realize that the U.S. dollar they cherish so much will never bring them true happiness in life.

The first thing to understand is that the U.S. dollar was not designed to be saved. The U.S. dollar was designed to be spent. It is the model of the system at the center of which is the U.S. dollar. To force you to spend all your hard-earned money, the central bankers keep increasing the money supply.

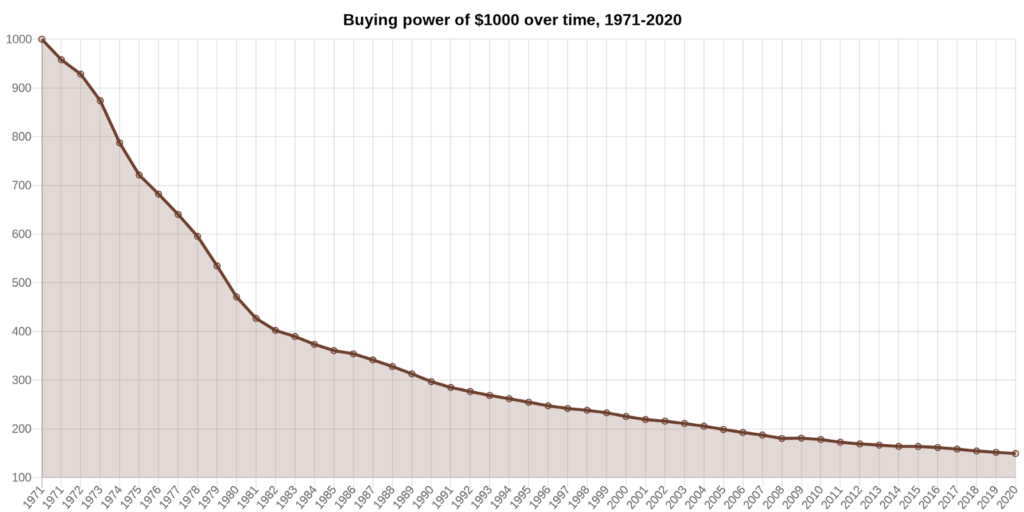

This endless inflation of the U.S. dollar, and other fiat currencies, induces an equally endless devaluation of your purchasing power.

In 2020, the purchasing power of $1,000 in 1971 is no longer even $150:

This drop of more than 85% in 49 years is quite phenomenal when you think about it.

The most unbelievable thing is to think that to keep the same purchasing power at $1,000 in 1971, you would have had to transform this amount into $6,426 in 2020. This could only have been done by making investments in different areas, but certainly not by saving your money in the bank.

Unfortunately, a majority of people do not have the opportunity to buy real estate, invest in the stock market, or buy gold to protect themselves from this monetary inflation.

The U.S. dollar is at the center of an unfair system

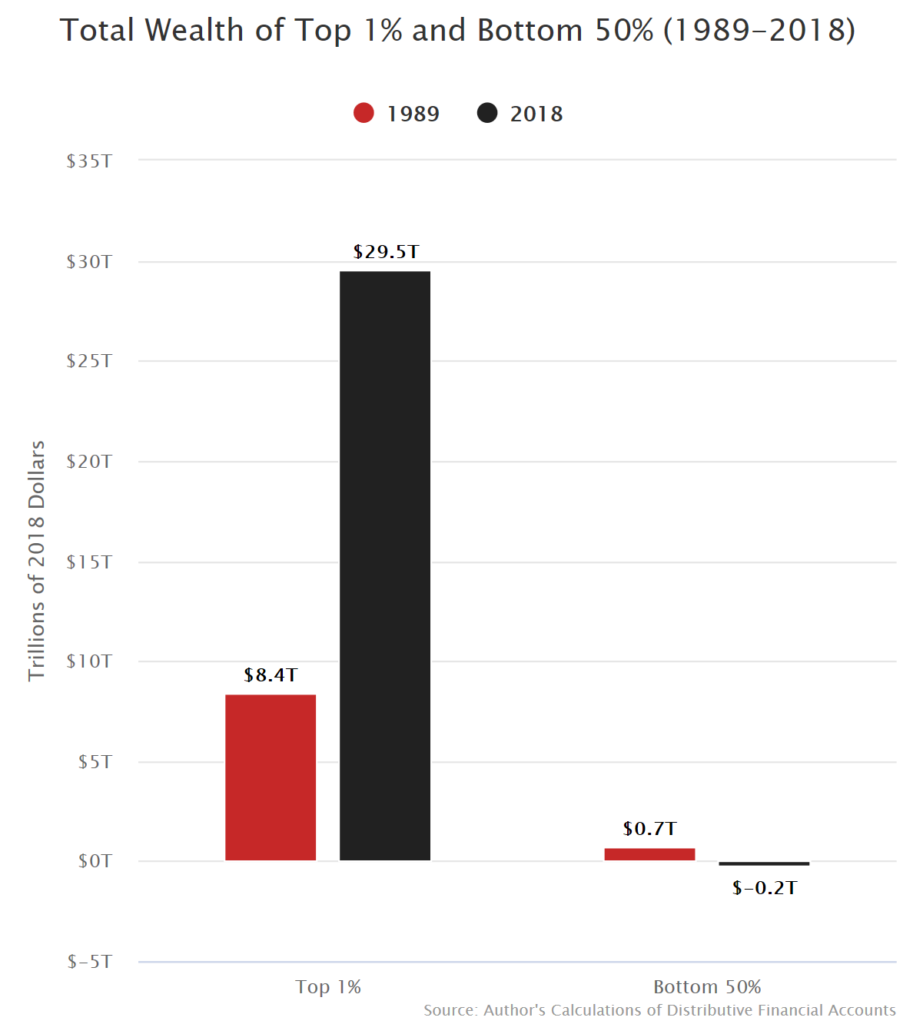

The current system is unfair because it produces a slow but inevitable impoverishment for a majority of people.

While the richest 1% of the population continues to see their wealth appreciate, the poorest 50% live in increasingly difficult conditions.

At the same time, the poorest 50% saw their meager wealth decrease by nearly $1 trillion.

The U.S. dollar is a currency that does not give equal opportunities to all U.S. citizens.

It is the same with all fiat currencies in the different countries of the world. However, hundreds of millions of people work harder every day to try to earn more U.S. dollars.

Since they can’t save their fiat money, they are doing the only thing the system expects of them: they are spending more and more money on totally useless things.

The U.S. dollar locks you into a vicious circle of impoverishment

The consumer society is very strong to persuade you that you have to buy those things that are useless in the end. Since you no longer see any point in saving, you end up giving in.

This leads you into a vicious circle that will prevent you from achieving happiness. I am talking about true happiness here: having enough time to do what you want in life.

The U.S. dollar doesn’t give you access to this most precious resource in the world: time to live your life as you wish.

So clearly the solution is not to earn more U.S. dollars to spend. You have to look for a way out of this vicious circle that impoverishes you irretrievably over time.

Bitcoin is your way out of this vicious circle

Bitcoin is the exit you need. Officially launched on January 3, 2009, Bitcoin is a savings technology that gives you control over what you own. Once you own the private keys associated with your Bitcoins, you are the only master on board.

No one can confiscate your Bitcoins, or prevent you from using them as you wish. With more Bitcoin to save, you will have protected more wealth.

Therefore, Bitcoin gives you the freedom to live on your own terms. You can buy one Bitcoin in 2020 with the guarantee that it will still be one Bitcoin on 21 million in 10, 20, or 50 years. This guarantee is given to you by the fact that the Bitcoin offering is hard-capped at 21 million units.

Bitcoin has been steadily increasing in value since its launch. From $0.125 in October 2010, Bitcoin’s price has grown to over $13K in October 2020. No asset in the world has done better over the period. If you had bought $1,000 worth of Bitcoin in October 2010, you would have had the equivalent of $108 million in your possession when October 2020 came to an end.

As of November 20, 2020, the situation would be even better since the Bitcoin price is in the midst of a bullish rally and has exceeded $18K.

The more U.S. dollars you earn, the more Bitcoin you will be able to buy if you fully believe in its monetary revolution. You just need more Bitcoin to save.

This will help you be happier. It is not the possession of Bitcoin itself that will make you happier, it is what it will allow you to do. Indeed, you will have more time at your disposal. Time is the most precious thing on Earth.

Conclusion

Bitcoin is the scarcest human invention in history. More Bitcoin to save will help you get more time to live your life the way you want. Bitcoin will help you achieve true happiness in your life.

Few people realize it yet, but Bitcoin was designed to give every citizen the power to take control of their lives. When you buy Bitcoin, you decide to become your own master. You can then maximize your chances of achieving the happiness we all aspire to in life.

To help you reduce this knowledge gap, you should look at the 5 thought patterns holding you back to buy Bitcoin.