Bitcoin is the money of the people supported by the people. A unique invention in the history that puts people at the center of the system.

Bitcoin is a unique invention in the history of mankind.

You have probably heard this phrase hundreds of times. I apologize in advance because I use it frequently as well. At the same time, how can you not be enthusiastic about such an incredible invention as Bitcoin?

It’s hard to remain measured when you really understand the potential of Bitcoin to build a better world for all in the future.

Yet, some people may find it hard to understand why Bitcoiners constantly talk about a unique invention in the history of mankind when they talk about Bitcoin.

Some beginners may not dare to ask for information about it. This is a mistake, because any question, however trivial it may seem to some, is worth asking if the need arises. After all, Bitcoin’s motto is “Don’t trust, Verify”.

Bitcoin encourages you to develop your critical thinking skills. To do so, you need to do your own research and ask questions if necessary. Then, it will be up to you to synthesize and form your own opinion of things.

Money has not always been a prerogative of the States

Nowadays, a majority of people think that money creation should be a prerogative of the States.

This conception, which seems obvious to us today, is very recent. In the Middle Ages and until late in history, the control of money by the royal power was limited to certifying that a gold coin was equal to one gram of gold.

Kings did not have the power to act on the money supply in circulation as central banks do today.

Friedrich Hayek, who died in 1992, must be turning over in his grave after seeing central banks print more than $10 trillion out of thin air since March 2020. Friedrich Hayek was already concerned about all this in the mid-1970s.

For him, the big culprit was the English economist Keynes. He was guilty of pushing strongly the idea of control of currencies by governments and central banks.

To stop this inflationary spiral, Friedrich Hayek saw two possibilities:

- A return to the gold standard, which makes it possible by the scarcity of the precious metal to limit inconsiderate monetary creation.

- Or a competition between currencies.

Bitcoin is our best chance to finally get good money

The emergence of Bitcoin is thus the realization of Friedrich Hayek’s dream.

Indeed, Bitcoin exists in limited quantities. There will never be more than 21 million BTC in circulation. The monetary policy of Bitcoin does not depend on any arbitrary decision of humans.

Written into Bitcoin’s source code, Bitcoin’s monetary policy is programmatic. Everything is inevitable with Bitcoin.

New Bitcoins are not created out of thin air. Each Bitcoin produced will have required a significant consumption of energy. Anyone who criticizes Bitcoin on this point does not understand that this is precisely what makes Bitcoins so valuable.

The intrinsic characteristics of Bitcoin have incredibly positive consequences for those who possess it.

As long as you have the private keys associated with your Bitcoins, no one can confiscate them from you. No one can stop you from making the transactions of your choice around the world on the Bitcoin network as well. Bitcoin gives you total power.

Bitcoin allows you to resist censorship

Government authorities cannot censor you. The banks can’t do anything against you either. This is why I consider the potential entry of American banks into the Bitcoin world as bad news.

Bitcoin was designed to free people from the yoke of the central bankers and the private bankers. If you buy Bitcoin through a service offered by your bank, you would have the same problem as with the current banking system: you would be at the mercy of your banker’s arbitrary decisions.

Bitcoin’s programmatic monetary policy with very precise rules that will never change gives you enormous guarantees in an increasingly uncertain world. Unlike the money supply of the U.S. dollar and other fiat currencies that are constantly increasing, you know that the number of BTC will remain limited to 21 million no matter what happens.

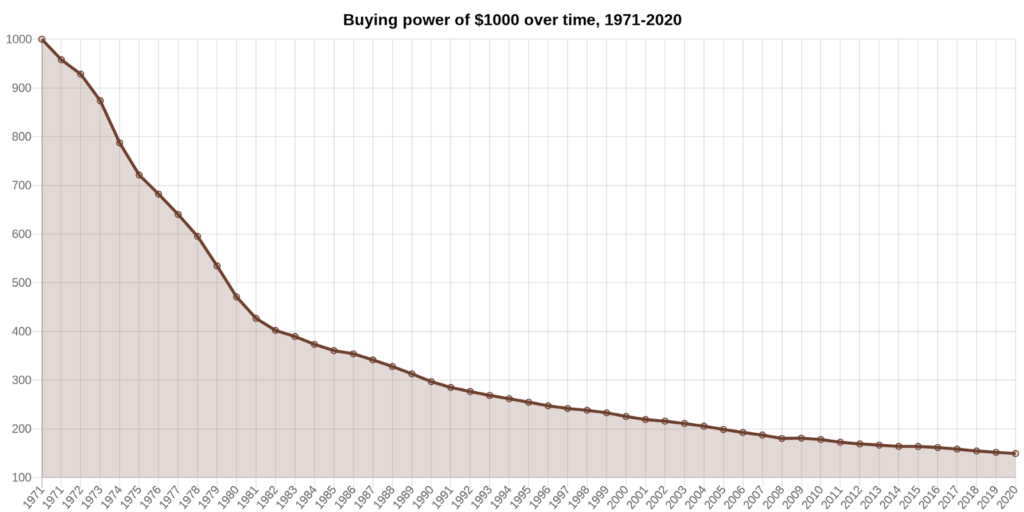

The Bitcoin people buy in 2020 will still represent 1 Bitcoin out of 21 million in 10, 20, or 50 years. With the U.S. dollar, you are rather guaranteed endless inflation of the M2 Money Stock. In 2020, you don’t need more U.S. dollar to spend, but rather more Bitcoin to save.

The endless inflation of the U.S. dollar keeps devaluing what you own

Your purchasing power in the U.S. Dollar will never stop decreasing. Since Richard Nixon introduced the current system in 1971, the U.S. dollar has lost 85% of its value. This is huge, and it makes any hope of saving your money useless.

The U.S. dollar was designed to be spent. Bitcoin is first and foremost a savings technology allowing you to opt for low time preference.

The emergence of Bitcoin has shown that the future of money is digital. It gave Facebook ideas to launch its own digital currency. The Libra project was launched with this in mind. The States have calmed Facebook’s ardor since then, but the idea is well in the heads of the Web giants.

By offering you their digital currencies, these Web giants could target your money habits even better. They would then be able to generate even more advertising revenue thanks to the fine knowledge they would have of all the transactions you make.

CBDC will be a threat to your right to privacy

If it’s not the Web giants, it will be the states that will try to impose their Central Bank Digital Currencies (CBDC) on you. China is advancing at high speed on its digital yuan project.

The e-RMB project is the missing piece in the massive surveillance arsenal that China has put in place over the last ten years with the Chinese social credit system.

Other states will follow China’s lead sooner or later. As a citizen, Bitcoin will be your best weapon to protect your society from the mass surveillance that is being built.

With Bitcoin, people will be able to protect their privacy when it comes to money. By combining Bitcoin with other decentralized tools, you can gradually regain your online sovereignty. You have to fight for it. A right is never definitively acquired.

Conclusion

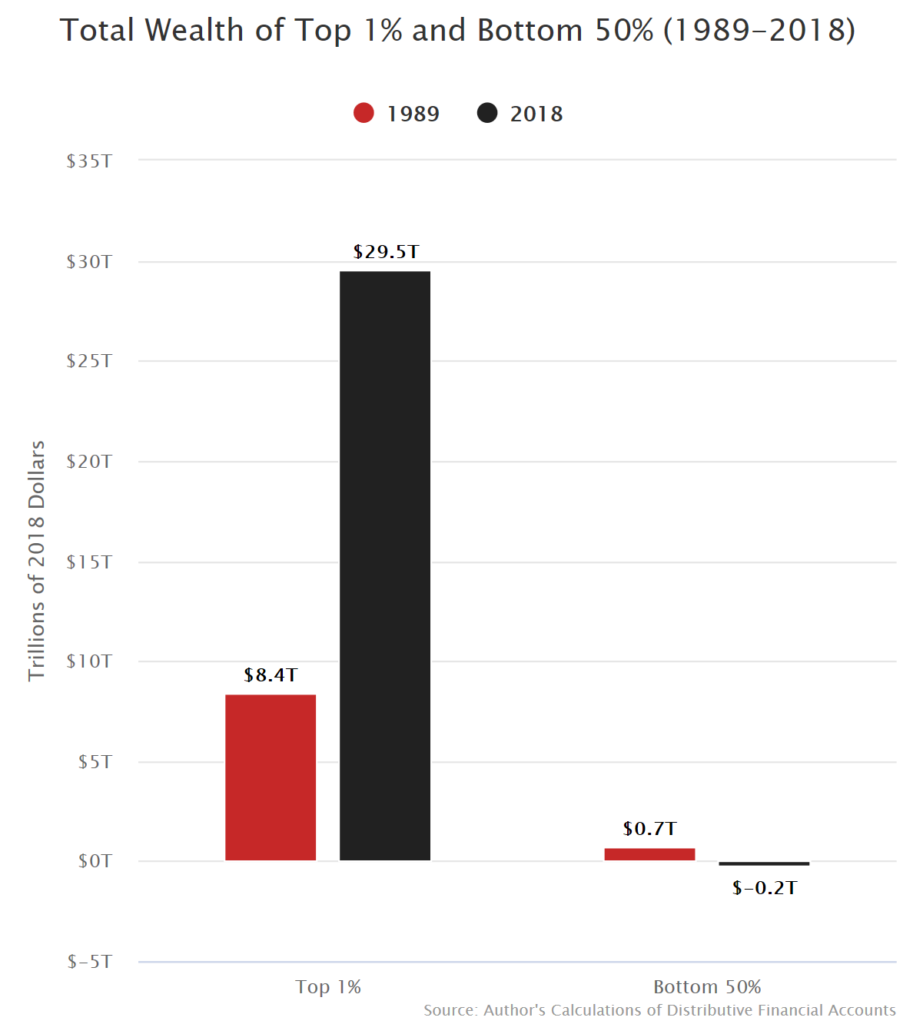

Contrary to some of society’s advantages that are restricted to the elite, Bitcoin is accessible to all. Bitcoin offers the same opportunities to all its users. Anyone can become a Bitcoin user. You can choose to take your destiny into your own hands by becoming a full node of the Bitcoin network at any time.

That is where Bitcoin’s great strength lies. Everyone is free to form their own opinion of the truth at any time. Bitcoin’s motto “Don’t trust, Verify” is not in vain. Bitcoin constantly encourages you to develop your sense of critical thinking.

By putting people back at the center of the system, Bitcoin is our best chance to build a better future world for all. It is up to you to come and participate in building that world.